Import PP and PE prices have been retreating since early March mainly because of insufficient demand across Asia and Turkey as per the pricing service of ChemOrbis. In the past few weeks, there were some questions, particularly in sellers’ minds, about whether a stable trend would be on the horizon for late April and early May based on the expectations about seeing some revival in end product applications.

However, the energy market has hampered these hopes recently after Brent crude went below the $100/barrel threshold and NYMEX touched $87/bbl in daily trading on Tuesday. The loss of the energy complex is right in line with the decreases seen in stock markets as well as many commodities. When compared to the beginning of the month, crude oil prices on the NYMEX are down nearly $9/barrel and spot Asian naphtha prices have lost $70/ton on CIF Japan basis.

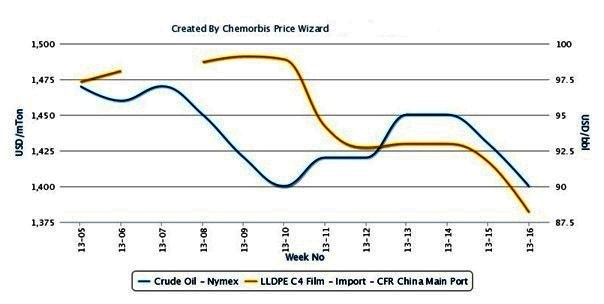

The trend in China’s import PP and PE markets has turned downwards recently after a stable trend that lasted for two weeks in a row. As can be seen from the graph above prepared by ChemOrbis Price Wizard, import LLDPE prices in China have responded to the losses in the energy markets this week, retreating $35/ton on average. The upcoming start-up of Exxon’s huge PE capacity made itself felt on prices more visibly while import PP prices posted relatively smaller decreases.

A similar feeling that prices will turn down again is in place in Turkey amongst PP and PE players. “There is no reason to justify that stabilization will take place now that crude oil has come down to $87/bbl and market conditions remain weak in China,” said a distributor. Import PP raffia prices have shed $10/ton on average on a week over week basis while the weekly loss of the import LLDPE market is larger, as can be seen from the graph below.

Buyers continue to hold onto their wait and see stance in Turkey as their end product orders are already limited according to ChemOrbis. Bids are reported $30-50/ton below the current offers in the import PP and PE markets.