PP prices resumed their downward trend after the recent holidays in China following the significant recent losses in energy markets as per the pricing service of ChemOrbis. Import prices are facing additional downward pressure from the local market as local cargoes continue to trade at a discount from imports, pushing many buyers away from the import market.

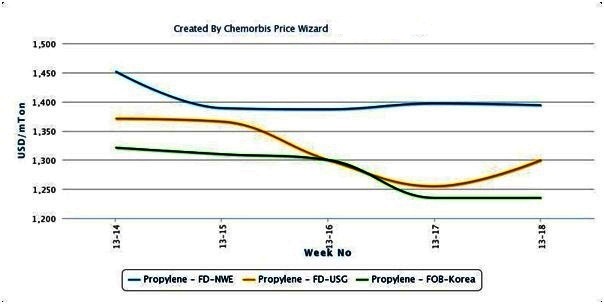

Before the recent Qing Ming holidays in China, players had been expressing hope that the PP market would stabilize based on stronger upstream costs. However, strong decreases in global oil and naphtha markets during the holiday caused many sellers to take a softer stance towards the market after the holidays. Crude oil prices on the NYMEX have dropped nearly $4/barrel since the start of April while spot naphtha prices on a CFR Japan basis have fallen almost $30/ton to move below the $900/ton threshold.

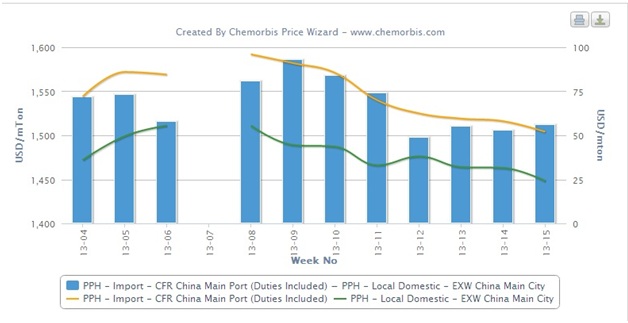

After declining for three consecutive weeks at the beginning of March, the premium carried by import homo-PP prices over domestic cargoes has leveled off over the past three weeks. After taking customs duties into account, import homo-PP cargoes traded more than $90/ton above local prices at the start of March. The premium dropped to around $50/ton by late March but has since stabilized, hovering between $50-55/ton over the past four weeks.

A converter manufacturing woven sacks in Shouguang stated, “We received lower prices from the import market but we still do not find import prices to be attractive given the fact that domestic producers also lowered their prices and local PP still trades at a discount with imports.” A trader in Ningbo said, “We received a new raffia offer with a $20/ton reduction from an Indian producer. However, we elected not to replenish at this level as we do not find the price to be sufficiently attractive. We believe that import prices will continue to move lower over the near term.”

According to ChemOrbis, a toy manufacturer based in Shantou stated, “We received lower prices from domestic producers after the holidays, but we elected to cover our immediate needs from the distribution market as distributors’ prices are more attractive than the prevailing producer price level. We do not plan to purchase beyond our needs now given the unclear market direction.” A distributor based in Shanghai reported, “We kept our prices unchanged this week but are willing to agree to some discounts to conclude deals. Stock levels in the bonded warehouses are said to be high and this is putting pressure on sellers to reduce their prices.”