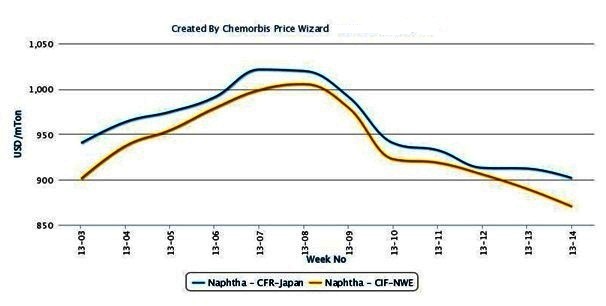

The revival in crude oil prices two weeks ago had given some hope to polymer sellers that costs would lend a hand in preventing a further downward fall in polymer prices as per the pricing service of ChemOrbis. However, during the same period, spot naphtha costs continued their downward trek.

A weak European market, combined with overall weak demand for naphtha, has been blamed for the softening naphtha prices. More recently, supply has increased out of the US, while crude oil prices weakened at the end of last week. Players in the naphtha market commented that demand for gasoline in Europe, which uses naphtha for blending, is weak. At the same time, US gasoline supply is expected to rise. The US Energy Information Administration (EIA) reported that operating rates at US refiners have risen to an average utilization rate of 86.3% as of the last week of March.

The general weakness in naphtha demand, stemming also from the slower sales into the petrochemical sector over the last several weeks, has been another contributor to improved supply in Europe.

In Europe, naphtha prices fell below $900/ton last week for the first time since early January, according to traders in the region. Views are mixed as to the future direction, however, some players commented that unless the European economy strengthens, they could not see much of a rebound in demand conditions and long supplies in the region could continue.

Meanwhile, traders reported that cargoes out of the US have been scheduled to move naphtha to Asia as supplies are lengthening in the US. Last Friday, crude oil prices on the NYMEX moved lower to settle below $93/bbl. Brent crude futures were also down to around $104/bbl. The crude markets eased down partly because of weak economic figures out of the US.

The fact that US employers hired at the slowest pace in nine months during March and added less than half the number of workers that were forecast for the month led to concerns about the country’s economic conditions and ultimately, demand for oil. US inventories were also at 22-year highs according to the EIA’s report on April 3.

In the polymer markets, Asian players reported at the end of the week that they remain cautious about their purchases according to ChemOrbis. Although they cannot be certain of the direction crude oil prices will move next due to recent volatility, more were of the opinion that though the polymer markets could stabilize, there was less likelihood of a rebound in the short term.