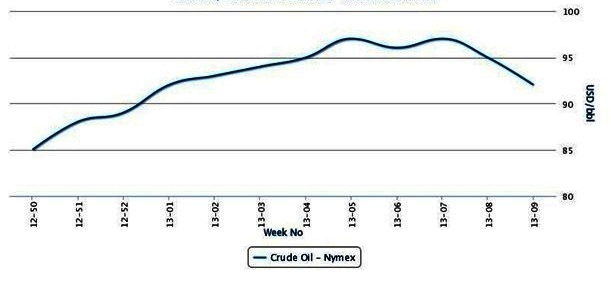

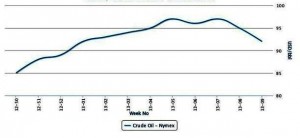

It has been three weeks that crude oil prices on NYMEX have been steadily easing, as per the pricing service of ChemOrbis. Around mid February, crude oil futures on NYMEX traded at around $97 per barrel on average, while this week’s average is down to $92 per barrel. The reason behind this gradual softening is mainly the supply concerns contributed by the poor economic results of global economies.

Earlier this week, crude oil futures on NYMEX traded around $93/bbl with heightened concerns that the euro-zone debt crisis may deepen upon the election results in Italy. The fact that U.S. crude stockpiles increased for the seventh week in a row dragged crude oil futures further down to around $92/bbl by the middle of the week. Crude supplies climbed 1.1 million barrels last week to 377.5 million, the most since July 20, 2012 the Energy Information Administration reported on Wednesday.

The news that the U.S. economy grew less than economists’ forecast in the fourth quarter also caused further softening in crude oil prices during daily trade on Thursday, pulling futures further down to $91.80/bbl before settling at $92.05/bbl. Gross domestic product grew at a 0.1% annual rate in the last quarter while the economy expanded 2.2 % for all of 2012 after an 1.8% increase in the prior year, the Commerce Department said.

The naphtha market has also followed suit and posted steady losses in the past three weeks. The Asian naphtha market was trading at around $980/ton on CFR Japan basis as of Thursday, although it was above $1020/ton on average in the middle of February, as per ChemOrbis.

The European naphtha market has also been lower recently with trades heard at around $970/ton on CIF NWE basis. When compared to a week ago, the market was above $1000/ton on average.